US markets

US equities extended losses on Thursday. Treasury yields surged after Federal Reserve Chair Jerome Powell’s speech renewed worries that interest rates would stay higher for an extended period. Meanwhile, elevated geopolitical tensions in the Middle East, overlapping with a further jump in oil prices, still kept investors on edge. The bellwether S&P 500 lost 0.8 percent, the tech-heavy NASDAQ sank 1.0 percent, and the blue-chip Dow Jones Industrial Average tanked 0.7 percent.

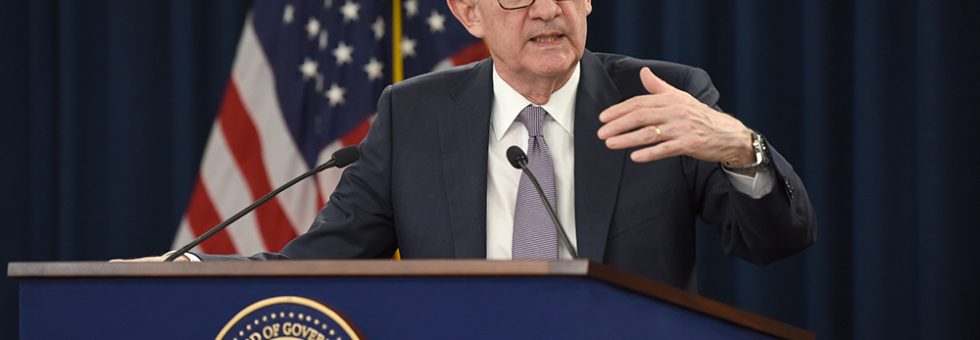

Powell’s speech and the latest jobs data provided additional insights into the monetary policy outlook. At an event at the Economic Club in New York on Thursday, Powell signalled that the recent economic strength and the continued tight labour market could lead to further rate hikes if inflation does not slow down as expected. Adding to evidence that the labour market remains at tight, data showed initial claims for unemployment benefits came below forecasts once again, falling to a nine-month low last week.

All the S&P sectors except communication services ended lower. The rate-sensitive real estate sector led the losses, followed by other cyclicals including consumer discretionary, financials and materials. Among the biggest drags on the consumer discretionary sector, electric vehicle maker Tesla plummeted 9.3 percent after posting its smallest quarterly profit in two years and its chief executive officer Elon Musk expressed concerns over the impact of high interest rates on demand. Asset manager Blackstone fell 7.9 percent after reporting weaker-than-expected results. Conversely, streaming giant Netflix surged 16.1 percent as it said it was hiking prices for some of its plans in the US, UK and France after adding 9 million users in the third quarter. Telecommunications service provider AT&T, up 6.5 percent, and American Airlines, up 0.8 percent, both posted upbeat quarterly results.

These price data reflect observations at market close: WTI spot crude oil rose by US$1.03 to US$89.35 while spot gold gained by US$13.15 to US$1,954.55. The US dollar was mixed vs. major currencies. The US Treasury 30-year bond yield rose by 11 basis points to 5.10 percent while the 10-year note yield rose by 9 basis points to 4.99 percent.

European markets

European equities finished lower on Thursday. Sentiment remained depressed due to concerns over a higher-for-longer interest rate environment and uncertainty over the Middle East turmoil. Moreover, a batch of disappointing corporate earnings sapped risk appetite further. The Europe-wide STOXX and the UK FTSE 100 shed 1.2 percent each, the German DAX slipped 0.3 percent, and the French CAC 40 slipped 0.6 percent.

Nearly all the Europe-wide STOXX sectors closed in negative territory, with health care and real estate declining the most, while information technology and utilities bucked the downward trend. Rate-sensitive real estate stocks took a hard hit, given the higher-for-longer view on interest rates. Weighing further on the sector, property portal company Rightmove slumped 14.3 percent after US real estate firm CoStar agreed to buy its competitor OnTheMarket. On the corporate earnings front, food giant Nestle tanked 3.5 after posting a lower-than-expected nine-month sales growth. Automaker Renault tumbled 7.3 percent after its third-quarter revenue fell short of market expectations. Nokia lost 6.5 percent as the telecommunications company announced plans to cut 14,000 jobs to save costs after third-quarter sales fell by a fifth. Conversely, technology stocks held up relatively well. Software company SAP rallied 5.1 percent after reaffirming its full-year key cloud business revenue outlook.

Asia Pacific markets

Asian equities broadly fell on Thursday. Stocks tracked losses in global markets amid surging government bond yields and escalating tensions in the Middle East.

Mainland China’s equities fell further as investors assessed the strength of the stabilisation in economic recovery. China’s CSI 300 sank 2.1 percent, and the Shanghai index slid 1.7 percent. Real state stocks fell after data showed new home prices in China’s 70 major cities continued their declines of 0.1 percent year-on-year for the third straight month in September. Housing demand remained weak despite relaxed rules on the property market. While most sectors finished lower, semiconductor stocks rose on the prospect of China’s self-reliance in technology, given the US had tightened chip exports to China. Hong Kong equities extended losses from the previous session, with the Hang Seng index closing down 2.5 percent, lagging behind regional peers. Property giant Country Garden Holdings, down 4.1 percent, was at risk of default on an offshore debt.

Japanese stocks pulled back after two consecutive sessions of gains, pressured by the selloff in technology stocks due to concerns over higher borrowing costs amid rising government bond yields in Japan and the US. The Nikkei index slid 1.9 percent, and the broader TOPIX dropped 1.4 percent. The rate-sensitive information technology sector led the decline, with chip-related companies Advantest and Tokyo Electron sliding 3.4 percent and 4.7 percent, respectively. Air transportation shares fell amid stronger oil prices as tensions in the Middle East deepened worries over oil supply. ANA Holdings dipped 1.8 percent, and Japan Airlines lost 2.4 percent.

Taiwan’s TAIEX edged up 0.1 percent. South Korea’s KOSPI tanked 1.9 percent. Indian equities declined for a second session, with the BSE Sensex down 0.4 percent, tracking the broader negative sentiment across global markets due to uncertainty around the Middle East clashes.

Australian shares snapped a two-session rising streak, with the All Ordinaries index down 1.3 percent. Investors were cautious about the risks of the ongoing conflict in the Middle East to global economic activity. Domestically, investors digested data showing the employment in September rose less than expected, while the jobless rate continued to fell. Most sectors registered losses, led by mining stocks. Major miners BHP Group, Rio Tinto and Fortescue Metals Group slid between 0.2 percent and 1.7 percent. Financial shares also fell, with the country’s largest four banks closing down between 0.9 percent and 1.9 percent. However, gold stocks tracked bullion prices higher, as investors rushed into safe-haven assets to defend against market volatility.